Keywords: Super Profits Tax

-

AUSTRALIA

- John Falzon

- 21 September 2023

3 Comments

In the face of Australia's pressing housing crisis, is the solution merely a question of funds, or does it demand a deeper overhaul? Many are calling for a transformed government role, one that abandons the shackles of neoliberalism, prioritises social infrastructure, and champions the collective good over select interests.

READ MORE

-

AUSTRALIA

- John Falzon

- 31 October 2022

3 Comments

In the first Chalmers budget we see a firm, albeit modest, assertion of the role of government in the long-term project of exiting the dismal and destructive era of neoliberalism and incrementally creating, in its place, a society where we have the collective resources to care for eachother, our planet and ourselves.

READ MORE

-

ECONOMICS

- David James

- 07 March 2017

17 Comments

Witnessing the debate over Sunday penalty rates, an intriguing pattern of thinking emerged. It can be characterised as a microcosm/macrocosm duality. Those arguing for lower Sunday wage rates demonstrate their case by talking about individual businesses, the micro approach: 'Many businesses would love to open on a Sunday and if wage rates were lower, they would. Unleash those businesses and greater employment will follow.' Superficially impressive, this does not survive much scrutiny.

READ MORE

-

AUSTRALIA

- Michael Mullins

- 02 February 2015

9 Comments

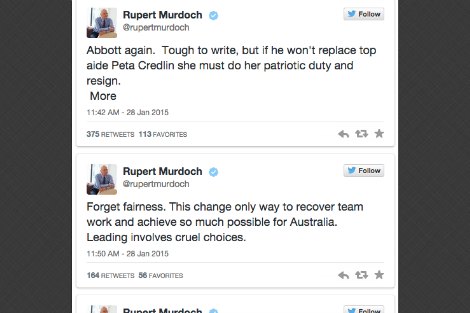

Rupert Murdoch’s tweets about the Prince Philip knighthood were as bizarre as the knighthood itself. It’s clear that the Prime Minister will not comply with Murdoch’s wishes because they were expressed so publicly and in such a self-discrediting manner. But if his directions had been issued behind closed doors, they might have been taken seriously and acted upon.

READ MORE

-

ECONOMICS

- David James

- 10 December 2014

12 Comments

One of the fascinating aspects of Australia's political pantomime is the manner in which the Federal Treasurer is forced to metamorphose into a used car salesman who is spruiking the Australian economy. One reason for the relative impotence of the Treasurer is that the Federal government only has control over fiscal policy. Monetary policy, the interest rate, is set by the Reserve Bank, not the government.

READ MORE

-

ECONOMICS

- David James

- 13 October 2014

7 Comments

Federal Finance Minister Mathias Cormann announced 'the scoping study found no evidence that premiums would increase as a result of the sale' of Medibank Private. But the sale is being presented as a way to make the fund more efficient. If successful, Medibank Private will become even more dominant than it is at present and there will be pressure to raise premiums to achieve its purpose of keeping shareholders happy.

READ MORE

-

AUSTRALIA

- Michael Mullins

- 01 September 2014

26 Comments

Prime minister Tony Abbott told an industry gathering in May that ’it’s particularly important that we do not demonise the coal industry’. Pope Francis is likely to do just that when he releases his new encyclical on humanity’s role in caring for the earth.

READ MORE

-

MARGARET DOOLEY AWARD

- Harry Maher

- 20 August 2014

14 Comments

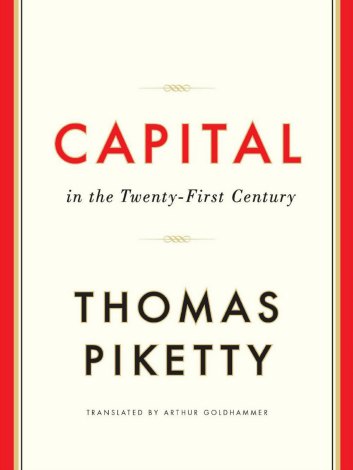

Inequality is dangerous. And inequality is at a near all-time high. At its core, the Government’s recent budget not only engenders but actively exults in the creation and maintenance of inequality, a phenomenon rapidly expanding not just in Australia, but around the world.

READ MORE

-

AUSTRALIA

- Michael Mullins

- 21 July 2014

8 Comments

The Coalition glorifies business entrepreneurship, which is promoted as a good that trumps social inclusion. It is paradoxical that there is more appetite for social entrepreneurship in the USA, which is known as the land of the self made man. The explanation is that investing in social capital ultimately makes good business sense.

READ MORE

-

AUSTRALIA

- John Menadue

- 18 October 2013

1 Comment

Some miners must be wondering whether they took the right course in opposing the Rudd Government's Resources Super Profits Tax, in which taxes would be levied on the profitability of the enterprise rather than royalties. Higher state mining royalties, lower commodity prices and higher costs will put the squeeze on the mining companies. It will be quite delicious to see them then urging a tax based on profits/losses rather than royalties.

READ MORE

-

ECONOMICS

- David James

- 27 August 2013

3 Comments

Australia is one of only a few countries in the world that has a franking credit system. Though it is designed to stop 'double taxation' on company tax, in many cases it ends up being a 'double reward' for entities that already have tax favoured status. Last year the Tax Commissioner generously refunded over $500 million to charities and not-for-profits on dividends because they pay no tax.

READ MORE

-

ECONOMICS

- David James

- 13 August 2013

3 Comments

As the China boom fades Australia is experiencing a delayed version of the GFC, without the banking crisis. Until now we've been reasonably well served by both sides of politics, in terms of macro-economic strategy. Now we require a way of dealing with more mundane economic issues like productivity and efficiency. Neither side has many good ideas about how to achieve the required structural shifts.

READ MORE